Living paycheck to paycheck can be a dark and distressing feeling. You pay the bills and put food on the table, but then struggle to make it the rest of the pay period. It’s hard to manage your money when you barely have any money in the first place.

I know the feeling all too well. I’ve been living paycheck to paycheck for my entire adult life. For the first 7 years that my husband and I were together, we had two incomes. But we still had trouble managing our money because we had fallen into the paycheck to paycheck trap. We paid bills whenever they came due, hoping that we’d have enough to last until our next payday.

Then, about a year ago, I became fed up with the struggle. I sat down and created a super simple budgeting system that would help us stay on top of our monthly expenses. This system worked so well for us that I was able to quit my job so I could stay home with the kids! Now we are able to manage our (small) income with no credit cards and no money saved in the bank.

Yes, you read that right. We have no credit cards and no money saved. We’re still living paycheck to paycheck, but we’re no longer struggling to get by every week.

So are you ready to find out how you can manage your money on a paycheck budget? I’ve broken down the process into 7 easy steps. Here’s what I’ve got…

Step # 1:

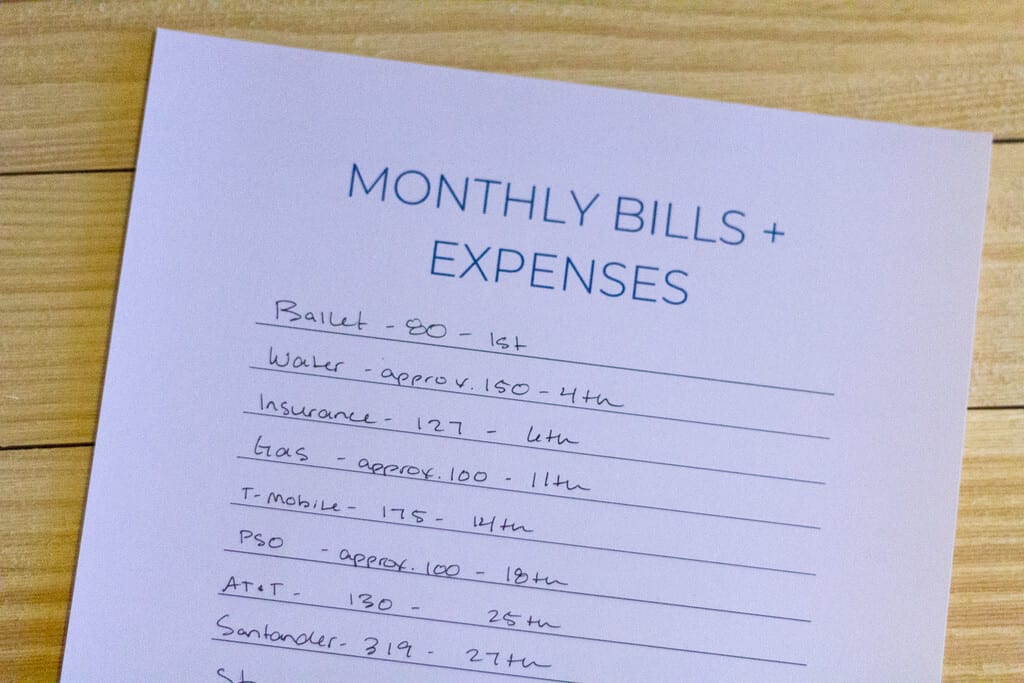

List Your Monthly Bills + Their Due Dates

This system works best when you include every one of your bills, so don’t skip this step!

When you’re living paycheck to paycheck, an unexpected $50 bill can leave you with no gas money for the week. So make sure that you write them all down.

You’ll only need to do this one time and then you will always have access to them at a moment’s notice!

I like to keep a running list in my budget binder that has all my bills with their perspective due dates.

If you can’t remember all your monthly expenses, look through previous bank statements. Or dig through that pile of unopened mail on your dining room table! 😉

Step # 2:

Determine When you Will be Paid Over the Next Month

Your pay frequency will make a big difference in your budgeting style.

For example, if you get paid every two weeks, you will generally be budgeting your money for two weeks at a time. While someone who gets paid weekly will only need to focus on one week at a time.

It might be helpful to write your pay dates on the calendar so you can visually identify which expenses are due from which paycheck.

My husband gets paid weekly so I don’t include his pay dates on my calendar. I just focus on a weekly budget since that is how often we have money coming in.

Step # 3:

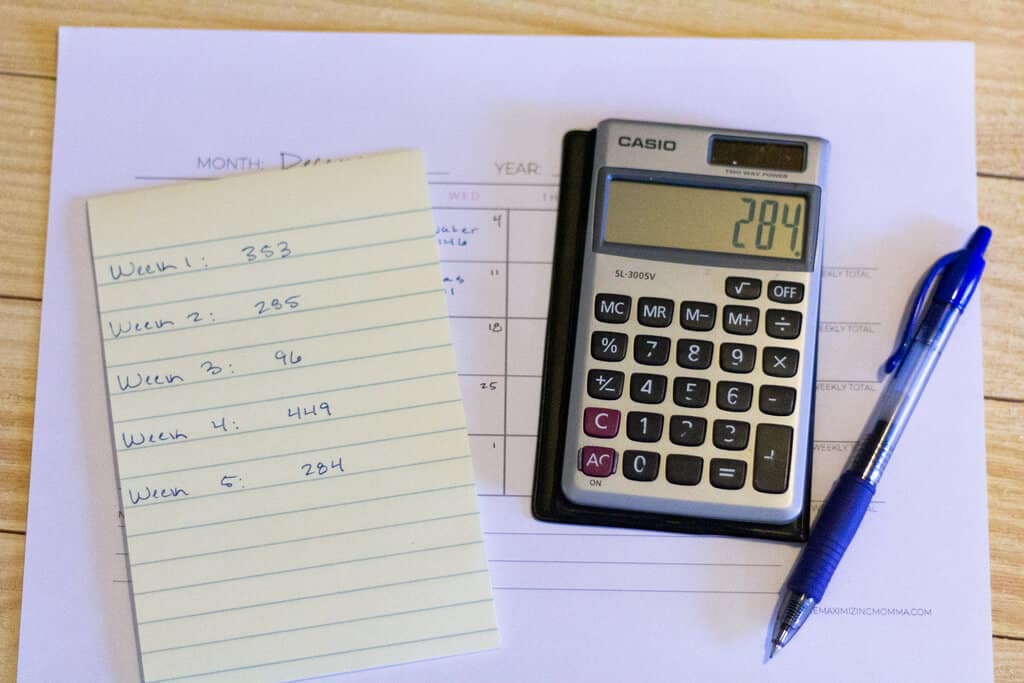

Add up Your Total Expenses from Each Paycheck

This step is easy too! Simply calculate how much you will be paying from each paycheck.

Since my husband gets paid weekly, I do this for each week.

If you get paid bi-weekly, you will do it for two weeks at a time.

So based on when each bill is due, my weekly fixed-expenses are:

- Week 1: $353

- Week 2: $285

- Week 3: $96

- Week 4: $449

- Week 5: $284

As you can see, some weeks are quite a bit different than the others! It’s hard to budget for unexpected expenses when each paycheck is drastically different.

But I’m able to make it work by spacing out my fixed-expenses.

What do I mean by “spacing out” my expenses? Keep reading…

Step # 4:

Do a Little Finagling to Make Your Expenses Easier to Manage

Living paycheck to paycheck usually means that you pay all your bills whenever they come due.

You might receive a cut-off notice and realize you have to pay your electric bill ASAP.

Or, you might even pay whatever you can afford for two weeks at a time until you get paid again.

But the problem comes in when your expenses are always different from one paycheck to the next.

One pay period might include $400 in expenses, while the next will include $800. The first paycheck will leave you with plenty of money to spare, while the second leaves you scraping to get by.

It’s much easier to manage your money when your expenses are the same from week to week.

And the best way to break that cycle is to try to space out your expenses.

By moving around a few of my bills, I am able to have a somewhat equal amount that is paid from each paycheck.

This allows me to budget better for non-fixed expenses such as groceries.

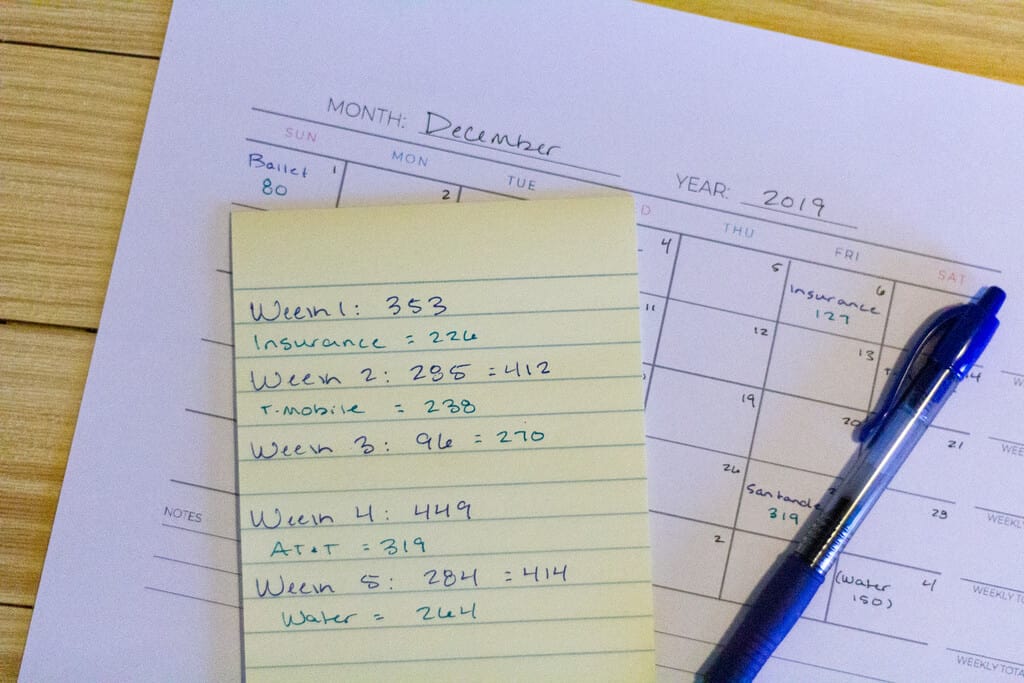

Let’s Break the Process Down Step by Step…

Week 1

For the first week of December, my total bills equal $353.

But by choosing to pay my insurance the following week, that takes my week 1 total down to $226.

Week 2

However, adding my insurance payment to week 2 will make the total $412, which is a little too much for my liking.

So by choosing to pay T-Mobile on a different date, that brings week 2 down to $238, which is a little bit more reasonable.

Week 3

Adding my T-Mobile payment to week 3 takes the total from $96 to $270, which is the amount that I’m aiming for!

Week 4

This week originally totaled $449.

But if I pay my AT&T bill next week, that leaves week 4 at $319.

That’s a little higher than the previous weeks, but $319 is more manageable than $449!

Week 5

For week 5, I made sure to include the bills that are due the first few days of January.

Moving AT&T to this week takes the total from $284 to $414.

So, I will continue the cycle by choosing to pay my water bill the following week, bringing the week 5 total to $264.

Adjusting the dates when I plan to pay certain bills leaves more equal weekly expenses across the board.

Here is how each of my weekly expenses add up after adjusting my bill payments:

- Week 1: $353 ⟶ $226

- Week 2: $285 ⟶ $238

- Week 3: $96 ⟶ $270

- Week 4: $449 ⟶ $319

- Week 5: $284 ⟶ $264

With each of our paycheck cycles having even fixed expenses, it’s much easier to create a plan for where the rest of our money will go!

One thing to note is that I’m only pushing my bills back by 1-2 weeks at a time. When I’m doing my calculations, I try to keep my bills within 10 days of their original due dates.

And I don’t always push every bill back; sometimes it works out better to move one up a few weeks.

Step # 5:

Use Arrows to Specify When You Will Pay Specific Bills

To make my adjustments easier to visualize, I draw an arrow pointing to the date in which I plan to pay a specific bill.

I usually pay all of the bills on the day my husband gets paid. So it doesn’t really matter if the arrows point to a certain day or a specific pay period.

I also total all the projected expenses from each pay period and add them to the column of the page.

If you get paid bi-weekly, you can add your expense totals for just the weeks you are paid.

A Few Tips…

This system might not work for everyone, depending on how often you get paid and which expenses you have.

👉 It’s not always reasonable to “move bills around”. Because there are some expenses that need paying within a certain amount of time before a late fee occurs.

👉 Car payments and credit card payments usually affect your credit. So I recommend adjusting your utility bills instead. Most utility services offer 30 day grace periods before late fees occur.

👉 This isn’t about paying your bills “randomly”.

The difference here is being intentional with when you choose to pay them!

Choosing to pay your water, gas, electric, or cable from a specific pay period might just make your expenses easier to manage!

👉 Try not to push your bills by more than 2 weeks. If you can’t make something work, adjust a different bill instead.

You can also include your non-fixed expenses, such as groceries or gas. I haven’t included them in this article because I wanted to make the directions as simple as possible.

But it’s super easy to add them to your budget. Personally, I factor in about $125 for groceries, $20 for gas, and $50 for miscellaneous expenses per week.

By getting a handle on your fixed expenses (like bills), it will be easy to budget for miscellaneous items. And eventually, even savings!

Make sure that you add each and every expense in a pay period, even if it falls under a different month.

👉 When you reach the end of the month, make sure to include the bills that are due the first few days of the coming month. Forgetting to include them could throw your entire paycheck budget off!

Your Turn

It can be extremely stressful to stay on top of your finances when you live paycheck to paycheck. But with this system, it will be easy to manage your money!

Having one calendar to look at is part of what makes this system so simple to keep up with.

The key here is to always space your expenses out evenly across every pay period. Doing so will prevent you from having a huge chunk of cash one week and practically nothing the next week.

Whenever you get paid, check your budgeting calendar and take note of what needs paying.

Then, make a point to pay those specific bills right away. Try to avoid waiting until the due date (which is a common habit when you live paycheck to paycheck).

By following this simple system, we have been able to cut back to only one income per month. And we are finally at a point where we can start saving!

If you’re living paycheck to paycheck and need an easy way to manage your money, this process really works!

Update April 2020

If you have recently lost your job due to the Coronavirus, the anxiety and uncertainty can be so overwhelming that it literally paralyzes you.

But the very best thing you can do is to reach out to your creditors and utility services and let them know what’s going on.

I know how scary it can feel. I know it’s tempting to keep putting it off with the hopes that you’ll find another job soon enough.

In these moments of anxious procrastination, I try to remind myself that I will feel so much better after having completed the task.

When you are at a stable place financially, you can use these tips to help you get back on your feet.

If you need someone to talk to, feel free to reach out!

Related posts

Find out How to Keep a Clean House

Simply Earth Subscription Box Review

Leave a Reply

You must be logged in to post a comment.